In the month of July 2022, the Indian Rupee hit a nine-month low of 79 against the US Dollar and had lost nearly 4.1% over the previous month itself. (at the time of scripting this)

As soon as this happened, there was a lot of panic among the retail investors.

While most of us think ‘Currency Depreciation’ is a bad thing, few of us know that it has both advantages and disadvantages.

In fact, sometimes countries purposely devalue their own currency to grow their economy.

The question is:

How is it possible that a drop in the value of a currency can benefit a country?

Why do countries purposely devalue their own currency?

Most importantly, as investors, what are the lessons we need to learn about the impact of the drop in our currency?

To understand this, let’s start from the basics of Devaluation.

We all know that the current dollar to rupee exchange rate is ₹79.16 meaning to purchase 1 USD I would need to pay ₹79.16.

Tomorrow, if India decides to lower this to a fixed ₹85 then it is said that that INR has been devalued. So now, I would have to pay ₹85 to purchase $1.

This is what devaluation of a currency is.

In technical terms, devaluation is an activity undertaken by the monetary body of a country to officially lower the value of the country’s currency within a fixed or pegged exchange rate.

This is usually done against the US Dollar.

What is happening right now, is not devaluation but the depreciation of the Indian rupee. So it’s not deliberate.

But while most of us might think this fall is a disaster, it’s actually not that straightforward.

Along with disadvantages, there are also several advantages that come with it.

Let’s try to understand both these aspects using 2 case studies:

The first country we have is China. It’s one of the greatest and bravest countries in the world. One of these bold steps was to devalue their currency.

This is a story that dates back to 2015.

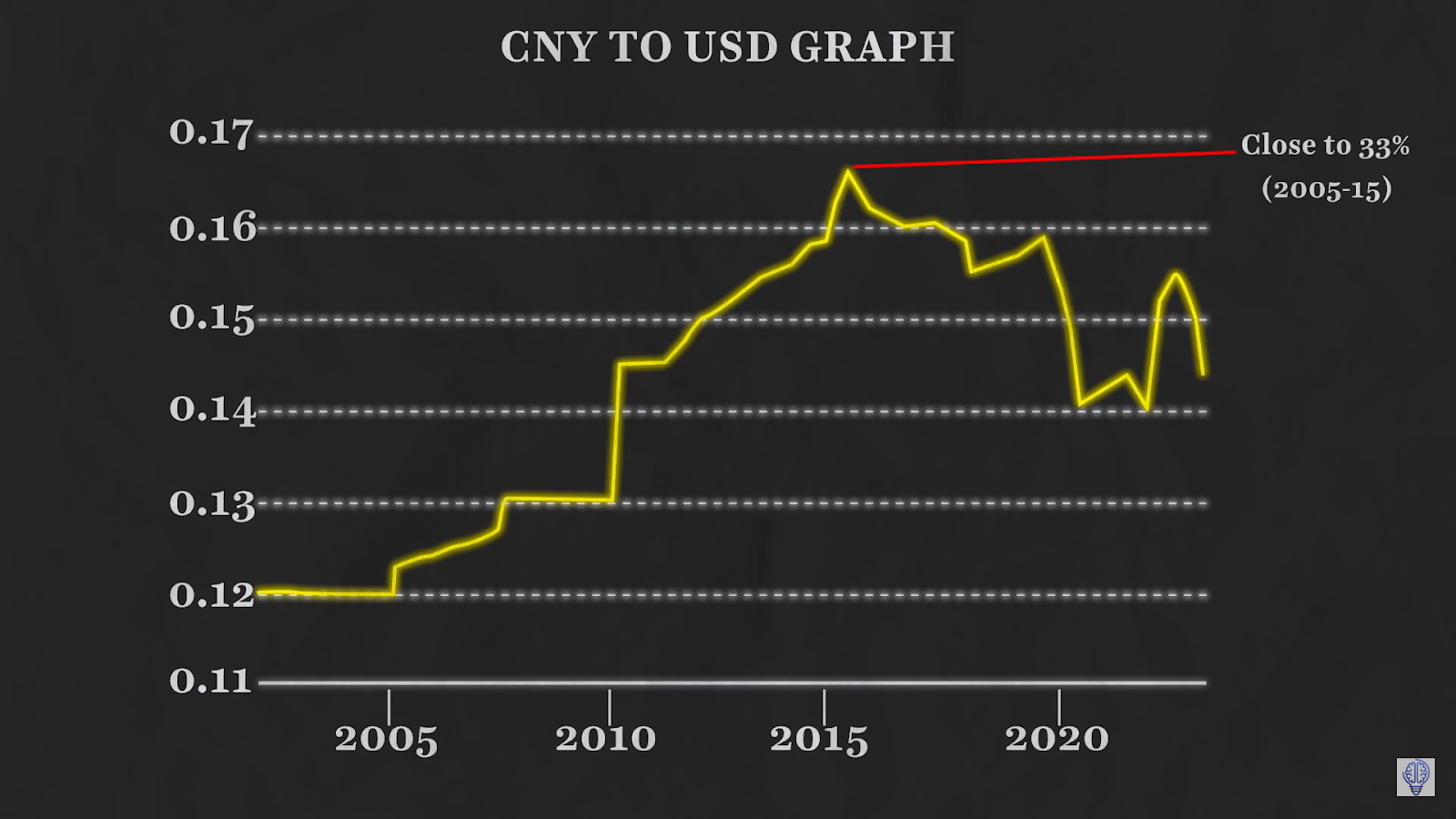

For 10 years, from 2005 to 2015, the Chinese Yuan had been growing steadily against the Dollar and appreciated close to 33%.

As a result, it has created a lot of positive sentiment amongst investors and the citizens of China.

But suddenly in 2015, the People’s Bank of China, (China’s version of the RBI), announced 3 consecutive devaluations of the Chinese currency, and the Chinese Yuan dropped by 4%.

This created a panic situation amongst the investors and even the stock markets across the US and Europe started falling.

The question is:

Why did China devalue its own currency and how did they benefit from it?

There are 2 reasons.

As we all know China was a very well known exporter of goods and commodities to many countries.

It was literally a manufacturing paradise with 20% of the entire world’s manufacturing happening in China itself.

But at the same time, the GDP growth of the country had been slowing down massively from 2008 till 2015.

So in order to boost exports, China decided to devalue their currency deliberately.

But

How does this devaluation benefit Chinese exports?

1$ was equal to 6 Yuan in 2015.

Eg. A company like Apple wishes to buy 500 Mn Yuan worth of Raw material from China. In dollar value, this would be worth $83.33 Mn.

But after China devalued its currency to 6.12 Yuan to the Dollar, the same company would only have to pay only $81.69 Mn for those goods. So when a country devalues its currency, it reduces the cost of a country’s exports making it more competitive and attractive in the global markets.

For instance, Vietnam, Bangladesh, and Indonesia greatly rely on their footwear and textile exports.

The reason why Bangladesh, Vietnam and Indonesian markets started growing was because the labour and exports from China had become very very costly.

But as soon as China devalued the currency, the labour became cheaper and these countries lost a lot of business during this time. Needless to say, Chinese exports started growing again.

Now the inverse also happened during imports.

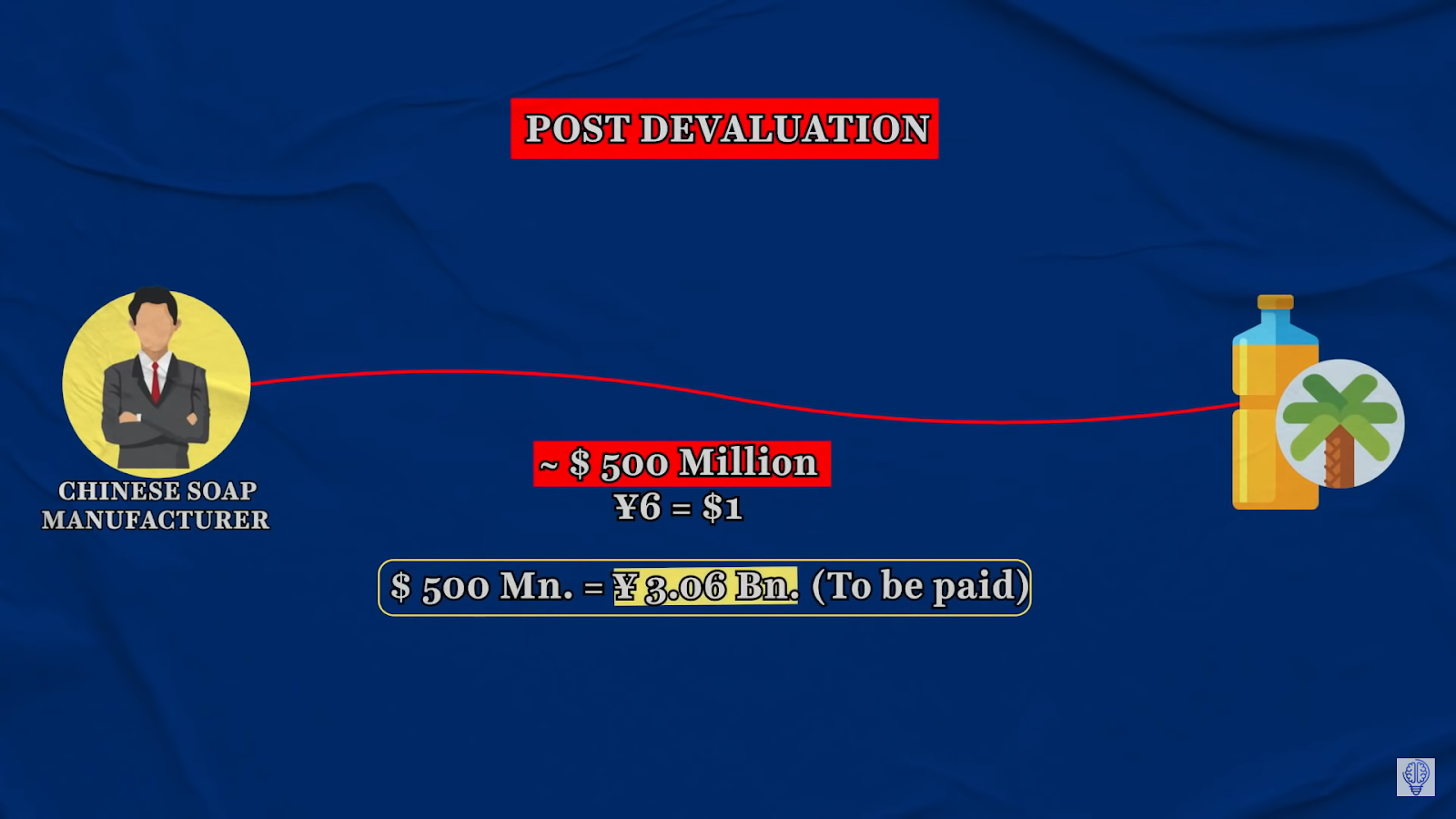

For example: If a Chinese Soap manufacturer imports palm oil worth $500 Mn, at 6 Yuan to the Dollar, she would have to pay 3 Bn Yuan.

But after devaluation, for the same $500 Mn worth of Palm oil, She would have to cough up 3.06 Bn Yuan

Palm oil could make upto 20% of the input cost of FMCG products.

So if soap costs 10 Yuan to be made, 2 Yuan will be incurred by Palm oil itself. So after devaluation, the cost of Soap and every other import based product will increase resulting in inflation.. This is the second outcome of devaluation.

Thirdly, when import costs increase it is “expected” to incentivise domestic production,

Eg. In India, when an import duty was imposed on the Chinese imports, the cost of these imports went up and suddenly there was a high demand for domestic production of Solar wafers eventually benefitting Indian Companies. So whenever the cost of import increases whether that is due to devaluation, economic crisis or even war, Domestic industries benefit.

The catch is that they will benefit only if they are ready to embrace the demand. For example: If suddenly the cost of Semiconductor imports increases Indian industries cannot benefit from it because they don’t even have the capability to compete with Taiwan yet.

So it would be incorrect to say that Devaluation directly incentivises domestic industries because it quiet subjective to which industry, what sort of economic condition and the condition of the those industries to embrace the change.

Lastly, we come to international repurssions.

You see guys China is the world’s largest energy consumer. It consumed 145 exajoules in 2020 compared to the US which stood at 87 exa joules. So thats humongous difference.

So since it’s the largest energy consumer, China has a major say in how crude oil is priced. So when devaluation happened, Oil price to china went up and China imported lesser oil. and during that time, the middle east was already pumping out a lot of Oil. So when China cut its oil import, a huge chunk of oil demand went away as a result the oil prices fell down and Brent crude went down by 20% and this benefited India and the other countries.

At the same time, if you remember, during this time, President Donald Trump got extremely angry at China for currency manipulation.

And he imposed tariffs on cheaper Chinese goods. This started a massive trade war between the US and China until Covid hit the US in 2020.

Devaluation is not something only China did, it is a common occurrence among nations and has a major impact if its a powerful country like China, US or the European Union countries.

So the key takeaways we have is,

when the value of your currency goes down there are multiple outcomes.

Cost of export decreases, so if you are in close competition with other countries, you have a chance of winning back your business.

Import cost increases so input cost of import based products increases which causes inflation. and at the same time, it is expected to promote domestic production.

and lastly, it has international repercussions if you are a giant player.

Now the question is: Did the GDP growth of China accelerate, well not really, while GDP growth remained sloppy, the exports of China increased by an extraordinary rate going from 2199 billion dollars to 2655 Billion dollars in 2018 which is an increase of 20.7% in just 2 years.

So the question is, Is devaluation a good thing to happen?

Well let’s have a look at the other side of the coin. here is where we have the second case which is the devaluation of the Nigerian currency.

In 1981 for $10 Mn, you could get 6.1 Mn Nairas with the exchange rate being 1.63Nairas for a dollar. But over the last 40 years, the Naira have lost 99.8% of its value against the dollar.

So In 2021 for the same $10Mn, You would have to pay 4.1 Billion Nairas.

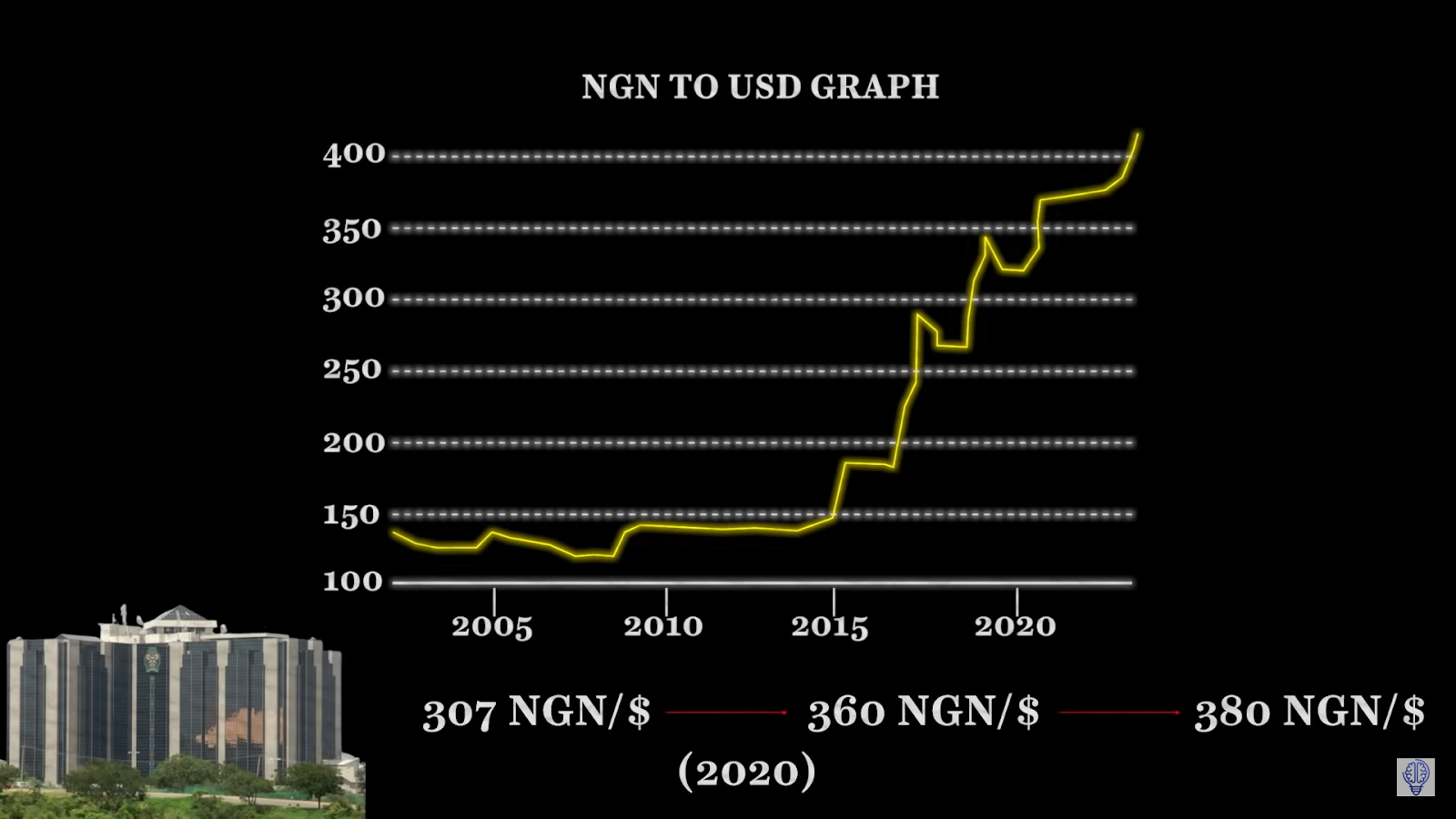

and This has come on the back of a series of devaluation efforts by the Central Bank of Nigeria or CBN. In March 2020, the CBN adjusted the official rate from 307 Nairas per $ to 360 Nairas per $ and then it was further adjusted to 380 Nairas per $ later.

and if you look at this graph you will understand how dangerously the spikes came up.

But when Nairas become so cheap, it should have boosted the exports of Nigeria? Because thats what happened in China. Well guess what?that did not happen at all , because for exports to increase you need more than just a devalued Currency.

For example: If a mobile company wants to give you a manufacturing project, you need to have ports, properly built factories, well built roads for transportation and steady government policies that you can rely on. and this was obviously not the case with Nigeria. On top of that, with such a drastic rate of Devaluation the import of Goods became extremely costly and inflation rate shot up to 16% in 2021. The prices of cement, sand, granite, iron rods and other building materials had risen by least 30%..

and the worst part is that, the very purpose of Devaluation, which was Foreign investment, actually came down drastically, it went from 24 Bn in 2019 to $9.7Bn in 2020 and further dropped to $6.7 Bn in 2021. Now the point to be noted is that this is not just because of Devaluation but also because of the pandemic.

So at the end of the day devaluation just accelerated the trouble for the citizens of Nigeria and now the country is facing a very very tough time.

So these are the 2 contrasting outcomes of Devaluations.

What are the lessons that we need to learn about Devaluation and the effect of Currency Value?

1) Devaluation of a currency doesn’t result in changes overnight. It takes time but in the long run, as seen in the example with China, it could turn out to be beneficial. If not, it could ruin your country like Nigeria.

More often than not when devaluation happens, It does have immediate impacts such as the plummeting of stock indices, fluctuations in prices of commodities such as crude oil and depreciating currencies of other countries.

- Increase in inflation that affects the end consumers like you and me.

The price of commodities goes up and we end up coughing up more money to living the exact same lifestyle. Then the Inflationary pressures will force the central bank of the country to step in and make amends.

Lastly, It is a common belief that a stronger currency would produce a stronger economy. But in reality a stronger economy would produce a stronger currency.

A simple call to action as an investor would be to see which companies are import heavy and which are export heavy and then find the potential gainers in the market.